A Quick Guide of CFD Trading Forex

By Robert DavisJul 2 2011

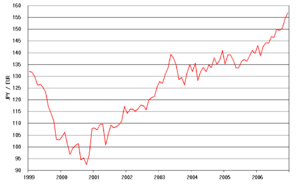

A Quick Guide of CFD Trading Forex - Image by Wikipedia

Forex is the most popular financial market in the world, one explanation of its importance is the diversity of participants it attracts, and the largest commercial banks, hedge fund managers to the individual. A significant amount of total trade is still carried out by the major currencies, such as the EUR / USD (Euro / Dollar), GBP / USD (Pound / Dollar), USD / JPY (Dollar / Yen) and EUR / GBP (Euro / pound).

Contracts for difference are a relatively new product that can have an economic cost. It is a flexible way to reverse the Forex market.

CFDs can anticipate future changes of a financial asset. The concept is easy; you “buy” if you think that the first listed Forex will strengthen in return for the second Forex. And you “sell” if you think it is likely to devalue.

Contracts for difference are a product line which means that by investing a relatively small amount, the profit can be considerable but losses too.

That is why it is important that you:

– Understand all risks.

– Use the tools of risk management as appropriate stop orders guaranteed.

– Choose carefully who will be your supplier.

– Understand all risks.

– Use the tools of risk management as appropriate stop orders guaranteed.

– Choose carefully who will be your supplier.

Supplier

First, be sure that the margins and spreads your CFD provider is competitive compared to other suppliers, but, remember, it’s not always the only factor you should consider.

It is important to choose a trading platform for sure, one that will not crash at the crucial moment where you’re going to take a position on the market but also one that provides accurate transaction processing and instantaneous. The platforms may look similar at first sight but the sophisticated technology behind it is the key.

Finally, check if they provide resources that can help you become a better trader. Watch the webinar, the regular updates of stock points and comments of financial analysts, but also advanced graphics.

Also note that trading in CFDs carries a high risk and may result in loss of an amount in excess of your initial deposit. So be sure you fully understand the risks inherent in such operations.